|

| AB vs 2 have not provinces |

Let's throw some more numbers in there. Unemployment rate in Alberta is 6.6% according to Alberta's own economic dashboard. That's not that bad - I remember reports of saying a healthy unemployment rate should be around 7% to enable companies to get the people they want. Of course I would say that because I'm not among the unemployed but

There are lots of small businesses built around a single resource. Should oil come around the challenge to those business will be big companies having a 90 day billing turnaround unless the business wants to take a 1-2% hit on invoiced services.

Alberta has a high percentage of households reliant on a single income because that income was so high. That income goes away and suddenly there's a spending problem if available income streams are a lot less that the previous ones. Alberta has a lot of low costs - insurance, tuition etc. that people have budgeted around. As they increase that will add pressure to household budgets as well.

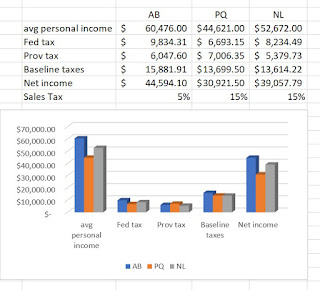

About that equalization money - it's generated by Federal and Sales tax and some other revenue stream that don't apply to individuals. How can Alberta claw back its contributions? It can't on a provincial level because there is no provincial contribution. The CPC under Harper did cut back the GST by 2% so that lowered Alberta (and all provinces) contributions. It was balanced by an increase in personal and corporate taxes and contributed to the Federal deficit. Albertans, overall, could take jobs that pay less. This isn't a quick solution since, even in the face of all the job loss over the past few years, Alberta has enough high paying jobs to have the highest average personal income. Even if wages fall, Alberta could implement a sales tax to raise revenues. Until there is one in place there is an unrealized income source.

What can the Federal Government do?

I think it's a mistake to focus on what Alberta/Saskatchewan "want". A look at the electoral map shows a lot of less urban areas feel left out of Canada's economic growth. The LPC is on the right path saying it will reach out at the municipal level. It is very hard to get people to move away from big cities. Grants for infrastructure improvements (airports, internet access) to make small centers more appealing could be a good step with the government approaching communities rather than putting out an application process. Use on-line tools to foster positive engagement between stakeholders as solutions are sought.

The Feds could talk up improvements made in the oil patch to lower emissions as well as the safety of pipelines in Canada. When there are so many spills in the US either Canada are doing something right or hiding spills. Make the process more transparent - after all the Feds own the pipeline so it's not corporate information. But whatever they do - no more corporate welfare to profitable companies.

And if Alberta and Saskatchewan want to separate - Quebec couldn't do it and they have control over the St. Lawrence seaway so good luck.

No comments:

Post a Comment